Debt Consolidation: How to Combine Debts and Save Money

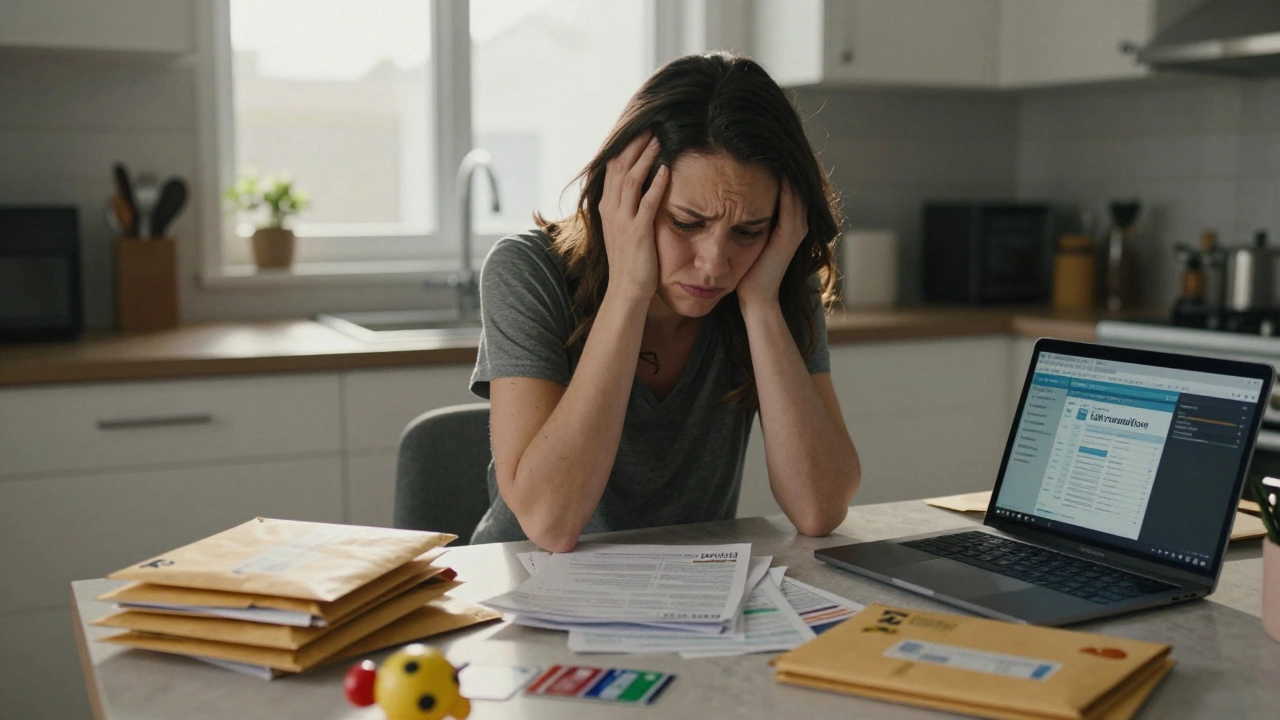

Feeling swamped by multiple bills? Credit cards, personal loans, store finance – they all add up and make budgeting a nightmare. Debt consolidation promises a single payment, lower interest, and more breathing room. But is it the magic fix you hope for, or could it cost you more in the long run? Let’s break down the basics, see how it hits your credit score, and point you toward the safest choices.

How Debt Consolidation Affects Your Credit Score

First thing most people worry about – will consolidation hurt my credit? The answer isn’t black and white. Applying for a new loan triggers a hard inquiry, which can shave a few points off your score. That dip is usually temporary, though, and disappears after 12 months if you keep up with payments.

On the flip side, moving from several high‑interest balances to one lower‑rate loan can improve your credit utilization ratio – the amount of credit you’re using versus what’s available. A lower ratio is a win for your score. The key is to avoid opening new credit lines while you’re paying off the consolidation loan; otherwise, you could undo the benefit.

Our article "Does Debt Consolidation Hurt Your Credit? What Happens To Your Score" dives deeper into the good and the bad, so you know exactly what to expect before you sign anything.

Choosing the Right Consolidation Option

Not every consolidation method fits every situation. Here are the most common routes and what to watch for:

- Bank or credit‑union loans: Usually offer the best rates, but they demand a solid credit score and lots of paperwork. See our guide "Debt Consolidation Loans: Do Banks Actually Offer Them?" for a checklist.

- Personal loans from online lenders: Faster approval, but interest can be higher if your credit isn’t stellar.

- Balance‑transfer credit cards: Great for short‑term relief with 0% intro periods, yet fees and high rates after the promo can trap you.

- Debt management plans (DMPs): Set up through a credit‑counselling agency, they consolidate payments without a new loan, but you’ll pay a monthly agency fee.

Before you pick, calculate the total cost: loan fees, interest, and any hidden charges. If the numbers add up to more than you’re paying now, the plan might not be worth it. Our post "Understanding the Costs of Debt Consolidation: Is It Worth It?" has a handy calculator template you can copy.

Also, beware of two major pitfalls highlighted in "Problems with Consolidation Loans: Unraveling Two Key Issues" – unexpected fees and a false sense of security that can lead to more spending. Stick to a budget, and treat the single payment as a permanent reset, not a free pass.

Ready to start? Begin by gathering all your debt statements, note interest rates, and compare them to the rates offered by potential lenders. Use the free comparison table in "Best Debt Relief Companies for 2025" to see which providers are transparent about fees and customer satisfaction.

Remember, consolidation is a tool, not a cure. Keep tracking your spending, avoid taking on new debt, and watch your credit score bounce back. With the right plan, you can turn a chaotic pile of bills into a manageable monthly amount and get back on track financially.

Will a Debt Consolidation Ruin My Credit? The Real Impact Explained

Debt consolidation won't ruin your credit if you use it wisely. It can actually boost your score by lowering credit utilization and simplifying payments. Learn how it works, when it helps, and the mistakes that make things worse.

What Credit Score Do You Need for a Consolidation Loan in Australia?

Find out what credit score you need for a consolidation loan in Australia, how lenders judge your application, and how to improve your chances - even with bad credit.

What Happens After 7 Years of Not Paying Debt in Australia

After seven years of not paying debt in Australia, legal action becomes impossible and credit listings disappear. But the debt still exists-here’s what really happens, what collectors can still do, and how to rebuild your finances.

Can I Buy a House After Debt Consolidation? Here's What Actually Happens

Buying a house after debt consolidation is possible-but only if you've rebuilt your finances over 6-12 months. Learn what lenders look for, how your credit score recovers, and how to get approved.

Can I Get a Loan to Pay Off Debt? Here’s How It Really Works in 2025

Can you use a loan to pay off debt? In 2025, debt consolidation loans can simplify payments and lower interest - but only if you stop spending. Learn how they work, who qualifies, and the hidden risks most people miss.

How to Put All Your Debt Into One Payment: A Simple Guide to Debt Consolidation

Learn how to combine all your debts into one simple payment using debt consolidation. Discover the best methods, avoid common traps, and find out if it’s right for your situation in 2025.

How Much Debt Is Too Much to Consolidate? A Realistic Guide for Australians

Learn when debt consolidation helps or hurts. Find out your debt-to-income ratio, avoid common traps, and discover if you're ready to truly get out of debt - not just rearrange it.

How to Pay Off $30,000 Debt in One Year

Learn how to pay off $30,000 in debt in one year using proven strategies like debt consolidation, the avalanche method, side income, and strict budgeting - without needing a windfall.

Negative Effects of Debt Consolidation Explained

Explore the hidden costs, credit‑score impact, longer terms, and stress that debt consolidation can bring, plus tips to avoid the pitfalls.

Does Debt Consolidation Hurt Your Credit? What Happens To Your Score

Worried if debt consolidation hurts your credit? This guide breaks down how it affects your score—both the good and the bad—so you know what to expect.

Best Debt Relief Companies for 2025: Top Choices Reviewed and Compared

Looking for the best debt relief company? This guide covers top options, what to watch out for, and easy tips so you pick the smartest path to be debt free.

How to Consolidate All Your Debt Into One Payment: Smart Ways to Make Debt Easier

Tired of juggling multiple bills? Find out how to put your debt into one payment, slash stress, and stay on track with your money goals—starting today.

- 1

- 2